In today’s fast-paced digital economy, seamless and secure payment processing is a critical factor for any business aiming to thrive online. Payment gateway integration enables businesses to accept and process various forms of online payments efficiently. In a commercial hub like Mumbai, with its diverse range of businesses, the demand for robust payment gateway integration services has surged as companies strive to provide their customers with safe, fast, and convenient payment options.

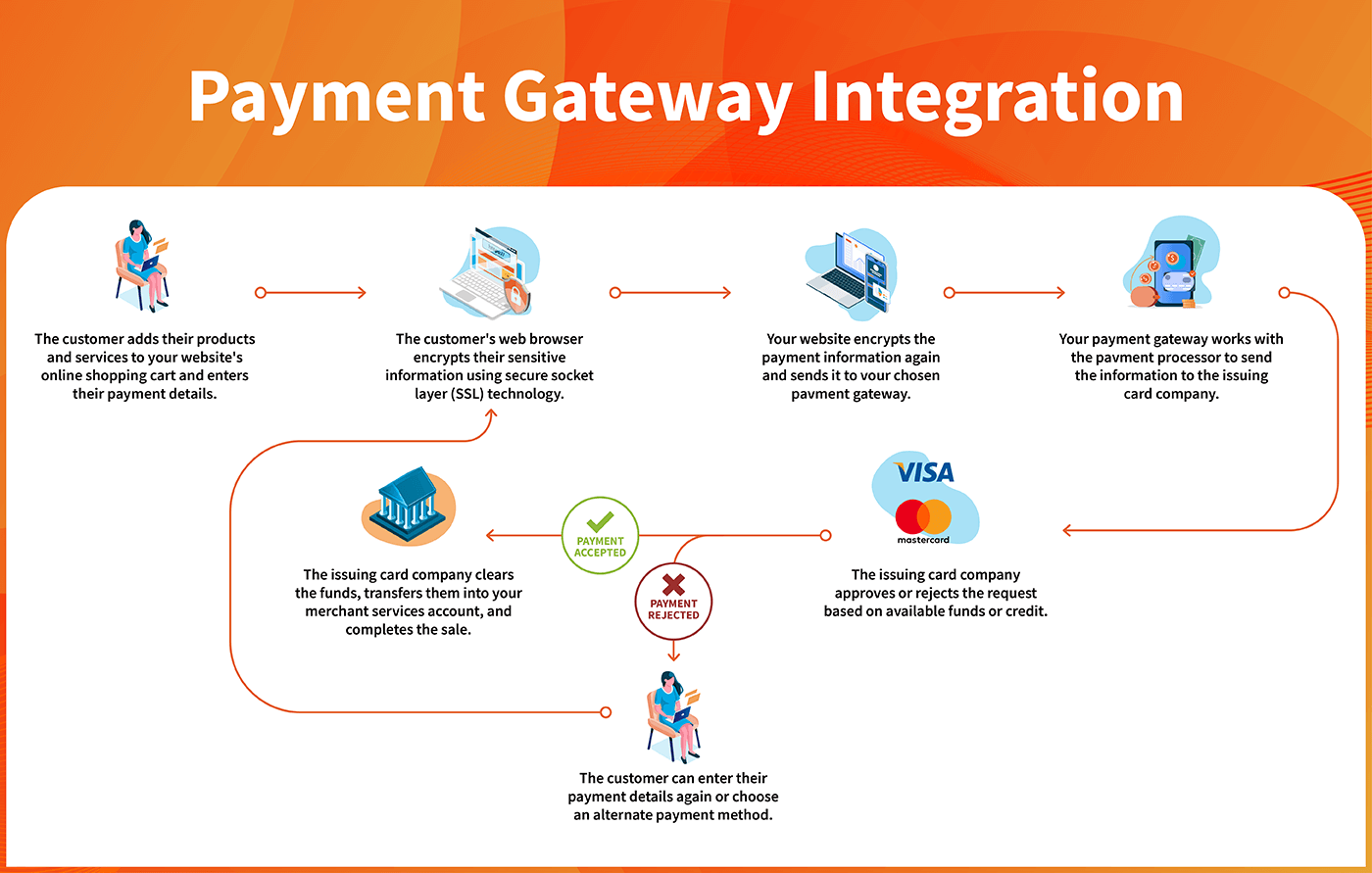

A payment gateway is a service that allows businesses to accept credit card, debit card, and other online payments from their customers. It acts as a bridge between the customer’s bank and the merchant’s account, facilitating the secure transfer of funds during an online transaction. Payment gateways are critical for e-commerce platforms, mobile applications, and even traditional businesses that want to expand their presence online.

Mumbai, being the financial capital of India, is home to a wide array of industries, including retail, hospitality, e-commerce, fintech, and more. As more businesses transition to digital platforms, the need for efficient payment gateway solutions has grown exponentially. Integrating a reliable payment gateway enables businesses to provide a seamless payment experience, ensuring customer satisfaction and boosting sales.

Whether you’re running an e-commerce website, a subscription-based service, or a brick-andmortar store with online capabilities, payment gateway integration is essential to streamline your operations and enable smooth financial transactions.

Businesses in Mumbai seeking payment gateway integration services should focus on the following key features that a gateway should offer:

Security is paramount in any financial transaction. Payment gateways use encryption technology, such as SSL (Secure Socket Layer) and PCI-DSS (Payment Card Industry Data Security Standard) compliance, to protect sensitive customer data. Fraud detection mechanisms are also integrated to prevent unauthorized access and mitigate risks.

As businesses expand their reach beyond local markets, the ability to accept multiple currencies becomes crucial. A well-integrated payment gateway allows businesses to accept payments in various currencies, making it easier for international customers to purchase products or services.

With the rise of mobile commerce, it is essential that payment gateways are optimized for mobile devices. Many payment gateway integration services in Mumbai offer mobile-friendly solutions, ensuring that customers can complete transactions effortlessly on their smartphones or tablets.

A payment gateway should support various payment methods, including credit cards, debit cards, UPI (Unified Payments Interface), digital wallets, and net banking. Offering multiple payment options ensures that customers can choose their preferred method, leading to a higher conversion rate and improved customer satisfaction.

A smooth user experience is key to reducing cart abandonment and ensuring successful transactions. Payment gateway integration should be fast, easy to use, and have minimal redirects or steps for the customer. Businesses in Mumbai benefit from gateways that provide a simple and intuitive checkout process, which can significantly boost sales.

For businesses offering subscription-based services, having a payment gateway that supports recurring billing is crucial. The gateway automatically handles regular payments, ensuring that customers don’t have to manually re-enter payment details, which improves user retention.

Crafting innovative web experiences with cutting-edge technology to elevate digital presence and user engagement.

For businesses in Mumbai, finding a trusted Payment Gateway Integration Service in Mumbai is essential for enabling secure and seamless online transactions. With Secure Payment Gateway Solutions in Mumbai, you can safeguard customer data while ensuring a smooth checkout process. Professional Online Payment Integration Services in Mumbai help businesses integrate diverse payment methods like UPI, wallets, and credit cards. Choosing the right Payment Gateway Integration Service provider in Mumbai ensures customized and reliable payment solutions for your business.

The best Payment Gateway Integration Service in Mumbai enhances the customer experience, improving trust and boosting satisfaction. Advanced Payment Gateway Integration Solutions in Mumbai streamline payment processes across platforms, ensuring efficiency and scalability. A dependable Payment Gateway Integration Service in Mumbai guarantees compliance with security standards, protecting sensitive information at every step. By opting for Secure Payment Gateway Solutions in Mumbai, you can provide your customers with a reliable and efficient payment system.

With expert Online Payment Integration Services in Mumbai, businesses can expand their reach and offer secure, user-friendly payment options. Partnering with a trusted Payment Gateway Integration Service provider in Mumbai ensures the implementation of robust payment solutions tailored to your needs. The best Payment Gateway Integration Service in Mumbai enables hassle-free payment integration, helping businesses grow in the digital era. My name is Fahim Shakir, and I proudly offer Payment Gateway Integration Solutions in Mumbai to help businesses thrive with secure and optimized payment systems.

Payment Gateway Integration allows businesses to accept online payments securely and efficiently, offering options like credit cards, debit cards, net banking, wallets, and UPI. It’s crucial for businesses in Mumbai to provide seamless, secure transactions, ensuring a great customer experience, enhancing customer trust, and increasing sales. It’s also a key element for businesses aiming to expand their online presence and reach.

Popular payment gateways in Mumbai include Razorpay, Paytm, CCAvenue, Instamojo, PayU, Stripe, and BillDesk. These gateways offer various features, such as multi-currency support, fraud prevention, easy checkout experiences, and tools for recurring billing. The best gateway depends on the business needs, such as transaction volume, fees, and payment options.

To integrate a payment gateway, sign up with your chosen provider, complete the necessary KYC documentation, and obtain API keys. Depending on your platform (e.g., WordPress, Magento, Shopify), the process can be streamlined with a plugin. Alternatively, you can manually integrate the API by following the payment gateway’s documentation. Most gateways offer clear integration guides and technical support.

Yes, when implemented correctly, payment gateway integration is highly secure. Reputable gateways use industry-standard security measures such as SSL encryption, tokenization, PCI-DSS compliance, and 3D Secure to protect sensitive customer data during online transactions. By selecting a trusted payment gateway provider, you can ensure that both your business and your customers are safeguarded against fraud.

The cost of payment gateway integration generally includes setup fees, transaction fees (typically 1% to 3% per transaction), and sometimes monthly fees for ongoing support or maintenance. Some providers offer flat-rate pricing or tiered plans based on your transaction volume. It’s important to review the fee structure carefully and compare different providers to choose the most cost-effective option for your business.